THE FED PAUSE

June 22, 2023

Inflation + Volatility

February 13, 2024A look at the macro themes driving markets, and the key risks and opportunities we are watching for the second half.

The first half of 2023 has been marked by lopsided gains in equity markets, with just a few large-cap tech companies accounting for nearly all of the S&P 500’s 16.9% year-to-date return1 through June 30, 2023. To put that in perspective, the S&P 500 Equal Weighted Index2 has returned just 7.0% YTD1 through June 30, a stark example of how narrow the leadership has been in the first half of 2023.

This year’s stock market rally has taken many by surprise, challenging the bearishness that seemed so prevalent in December 2022. From our perspective, investors were all but certain of three predictions for what was to come in the new year:

- A global recession was imminent.

- Bonds would finally beat stocks as equities were certain to make new bear-market lows.

- Central banks would be forced to stop the aggressive rate hikes that made 2022 such a year of market misery and be forced to begin cutting interest rates.

Fast forward six months to June 2023 and the December 2022 negative sentiment appears to have flipped bullish as equity prices rise and the fear of loss turns to the “Fear of Missing Out”

FOMO and THE CROWD

Dictionary.com defines FOMO as: “a feeling of anxiety or insecurity over the possibility of missing out on something, as an event or an opportunity”.

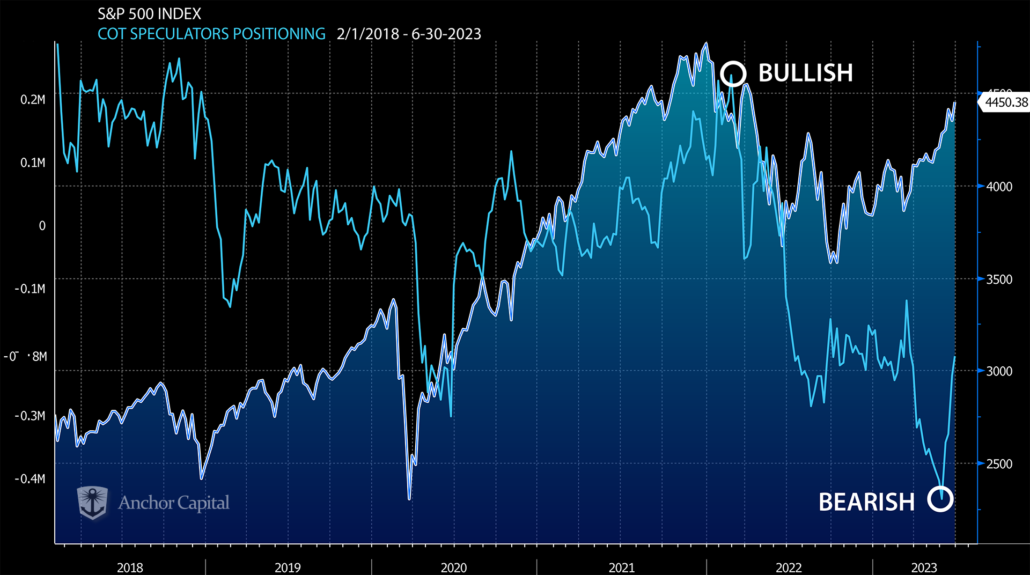

One way to monitor consensus extremes in crowd positioning is the CFTC’s weekly Commitment of Trader’s Report (COT), which shows futures and options positions separated by investor type. Commercial traders are typically farmers and ranchers utilizing commodity futures to hedge crop or livestock prices. Non-Commercial traders are speculators looking to profit from price movement, such as CTA’s, Institutions, and hedge funds3.

The chart below compares the S&P 500 Index to the weekly reported net Long and Short positioning for Non-Commercial speculators.

Source: Anchor Capital, Bloomberg, L.P.

According to the COT data in February, 2022 investors reached the highest level of bullish positioning since 2018- right into the teeth of the nasty Bear Market decline of 2022. Then, after missing the first half rally in 2023 with the most bearish positioning since 2020, investors are now scrambling back once again to chase the YTD rally. The FOMO is real.

We began 2023 with most Anchor strategies relatively hedged, scaling to higher net long exposures early in January. There have been a few moments where hedges have been applied to reduce volatility (SVB bank crisis, etc.). Still, for the most part, we have remained net-long with higher correlations to market indexes, benefiting from the rising price trends in the first half of 2023.

Raising Rates into a Slowing Economy

As the crowd turns from fear to FOMO, risks are again rising. Divergences are building between equity and fixed income, and we continue to be concerned about the lag effect of the Federal Reserve’s credit tightening against the backdrop of a slowing economy. From our Macro Minute commentaries this quarter, here are three key risks we will watch as we enter the year’s second half.

RECESSION WARNING from the LEI

The Conference Board’s Leading Economic Index combines ten different economic inputs in an attempt to provide early indication of significant turning points in the economy. Since 1960, each time the LEI dropped below -4.0, the economy was in recession. The April 2023 reading came in at -8.0, indicating we are in recession4.

LIQUIDITY DRAIN: Record Decline in M2

In April M2, contracted 4.6% year-over-year1. That’s the largest one-year decline since the Federal Reserve began collecting this data in 1959, and it’s a big, red flashing light about our recession risk.

The fact is, M2 has now contracted year-over-year for four straight months, starting in December 2022, which was the first M2 annual decline ever. It’s unprecedented. In the short term, we can expect inflation to ease but at the cost of a slowing economy and reduced spending. This could likely turn into a drag on the equity markets and, left unchecked, result in a full-fledged recession by the end of the year.

THE FED PAUSE

It finally happened, an end to the 15 months of Federal Reserve rate hikes. Markets have rallied since on the base assumption that a pause in rate hikes is bullish for stock prices. Over the past twenty years, the Federal Reserve has paused a rate tightening cycle three times. In all three cases, the pause was too late, and the economy was already in recession, with steep equity market declines shortly after that.

On The Bullish Side

While there are several additional macro risks on our radar, there are also some positive developments that may lead to continued equity gains. The deeply bearish positioning of the crowd in May has now created short covering and “forced buying” which could provide fuel for additional equity market gains. However, we would caution that FOMO is not a sustainable investment strategy. In our opinion, we will need to see improvement in both inflation and economic numbers for the rally to broaden out in the second half.