What’s Next for Equities

September 7, 2017Bear or No Bear-Here’s What to Expect Next

December 18, 2018Party Like It's 1999. For Now

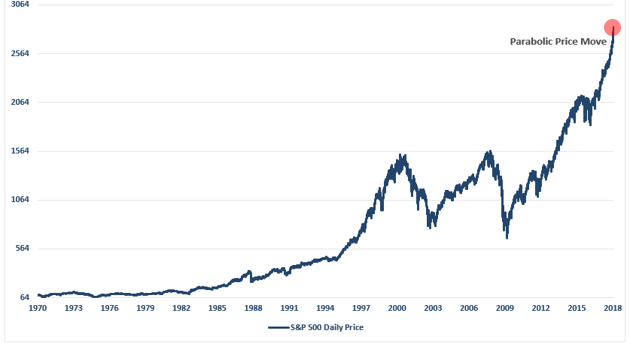

Its been an exciting start to 2018 for U.S. Equities. The advance of +6.2% in the S&P 500 Index in the first three weeks this year makes it the best start to a new year since 1987, and continues the strong momentum from last year. In 2017 the Dow Jones Industrial Average made 70 new all time highs, gained a record 5,000 points and the S&P 500 Index was positive for 12 consecutive months. 2017 also saw a record decline in volatility, as the S&P 500 Index produced a near record of number of consecutive days without a 1% decline.

The recent drop in volatility and its implications is a theme we've presented often over the past twelve months, and it was one of the reasons our equity strategies remained bullish for the majority of 2017. We've highlighted the similarities between the current environment and previous low-volatility momentum bull markets, like those seen in 1999 and 2007. (Here: Winning Streaks: Why You Should Pay Attention in February 2017 and Here: What's Next For Equities in September 2017 )

So after a record start to 2018, what's next? If the correlations to1999 and 2007 remain consistent, what's next may not be an easy ride higher for stock prices. Foundational to our risk-management process is the conviction that volatility is always mean reverting. Put simply, periods of extreme low volatility are almost always followed by periods of high volatility. Both 1999 and 2006-2007 are good examples of this, as both years represented lower volatility bull markets leading to major market tops.

Take a look a the similarities in major market themes of all three periods: 1999, 2007 and 2017.

Year: 1999

Speculative Asset of Choice:

".Com Stocks"

- Fed was hiking rates as worries about inflationary pressures were present.

- Economic growth/GDP was improving.

- Interest and inflation rates were rising.

- Earnings were rising through the use of “new metrics,” share buybacks and an M&A spree. (Who can forget the market greats of Enron, Worldcom & Global Crossing).

- Margin-debt / leverage was at the highest level on record.

- Stock market was beginning to go parabolic as exuberance exploded in a “can’t lose market.”

Year: 2007

Speculative Asset of Choice:

"Real Estate"

- Fed was hiking rates as worries about inflationary pressures were present.

- Economic growth/GDP was improving.

- Interest and inflation rates were rising.

- Debt and leverage provided a massive “buying” binge in real estate creating a “wealth effect” for consumers and high-valuations were justified because of the “Goldilocks economy.”

- Margin-debt / leverage reached another new all time high.

- Stock market was beginning to go parabolic as exuberance exploded in a “can’t lose market.”

Year: 2017

Speculative Asset of Choice:

"Bitcoin"

- Fed is hiking rates to remove liquidity accommodation and worries about inflationary pressures are present.

- Economic growth/GDP is improving.

- Fed is on the record to continue increases in Interest Rates to "normalize".

- Earnings continue to rise with the help of share buybacks.

- Margin-debt / leverage has reached a new all time high.

- Stock market was beginning to go parabolic as exuberance exploded in a “can’t lose market.”

You Are Here

In 2005 we coined the phrase: "Headlines change, but investor behavior is always the same." The catalyst for market sell-offs are different every cycle, but the behavioral instincts and emotional reactions of investors in response is quite dependable. After a parabolic move higher in equities and with the Volatility Index (VIX) at record lows, the market is due for a correction at best -- or something more ominous at worst.

No, we are not calling a major market top: we will leave that to newsletter writers and those with crystal balls. We will, however, continue to follow our disciplined process of measuring and mapping risk and opportunity across multiple time frames and asset classes. Right now our risk models are pointing to an environment skewed toward elevated risk, where our ability to hedge with short positions and reduce exposure should serve us well in our objective to both grow and protect capital.

The chart to the right probably illustrates it best: Caution, you are Here.