INVEST WITH

MORE CONFIDENCE

ATESX Seeks to Smooth Volatility. Manage Opportunity. Maintain Liquidity.

Investors are emotional. Many advisors will suggest they “stay the course” in good times and bad.

We’re different. We work with advisors to complement their MPT portfolios. Anchor Risk Managed Equity Strategy Fund (ATESX) can be a true diversifier which seeks to correlate to the market during low volatility rising markets and be uncorrelated during high volatility falling periods.

ATESX is an actively managed liquid alternatives fund designed to help your clients invest with greater confidence, offering a broader opportunity to seek positive investment returns in both bull and bear markets. Is your current risk strategy doing the job?

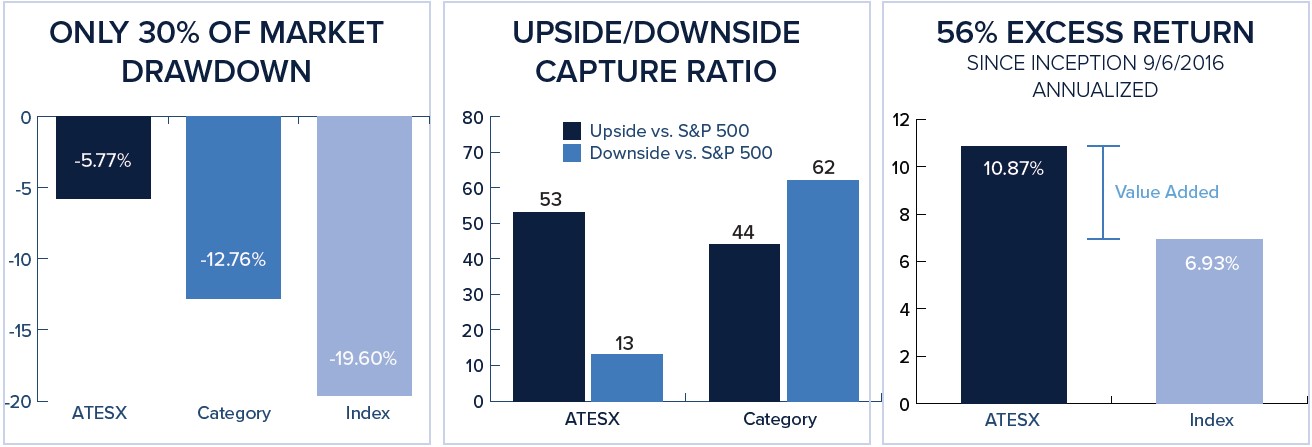

Significant Excess Return with 1/3 of the Risk.

INCEPTION TO 3/31/2020 vs S&P 500

Performance (%) (3yr and SI annualized)

AS OF 3/31/2020 INCEPTION 9/6/2016 EXPENSE RATIO 2.25%

AS OF 3/31/2020 INCEPTION 9/6/2016 EXPENSE RATIO 2.25%

| YTD | 1 YR | 3 YR | SI | CUM | |

|---|---|---|---|---|---|

| ATESX | -2.35 | 11.81 | 10.34 | 10.87 | 44.46 |

| S&P 5002 | -19.60 | -6.98 | 5.10 | 6.93 | 27.88 |

| LS Equity3 | -12.76 | -7.72 | -0.66 | 0.75 | 2.73 |

As of 3/31/2020 among 188 Long Short Equity Funds based on risk-adjusted returns overall and for the 3-year period.

As of 3/31/2020 among 188 Long Short Equity Funds based on risk-adjusted returns overall and for the 3-year period.The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund’s investment adviser has contractually agreed to reduce its fees and/or absorb expenses of the Fund, at least until December 31, 2020, to ensure that the net annual fund operating expenses will not exceed 2.25%, subject to possible recoupment from the Fund in future years. Please review the fund’s prospectus for more information regarding the fund’s fees and expenses. For performance information current to the most recent month-end, please call toll-free 844-594-1226.

ANCHOR INVESTMENT PROCESS

Driven by Research

Research is at the heart of what we do. We are perpetually curious and fascinated by markets. Its what drives us every day. Our investment process is built on a foundation of more than twenty years researching, developing and executing quantitative investment strategies that identify and exploit persistent, repeatable market inefficiencies in trends and volatility.A Quantitative Edge

Market volatility can test the nerve of advisors and investors alike. Personal bias and short-term decision-making often lead to missed opportunities and an increase in portfolio risk.We built our investment process to be unemotional. It’s driven by proprietary, rules-based risk models that are designed to systematically mitigate risk and identify opportunity in the strategies we manage.

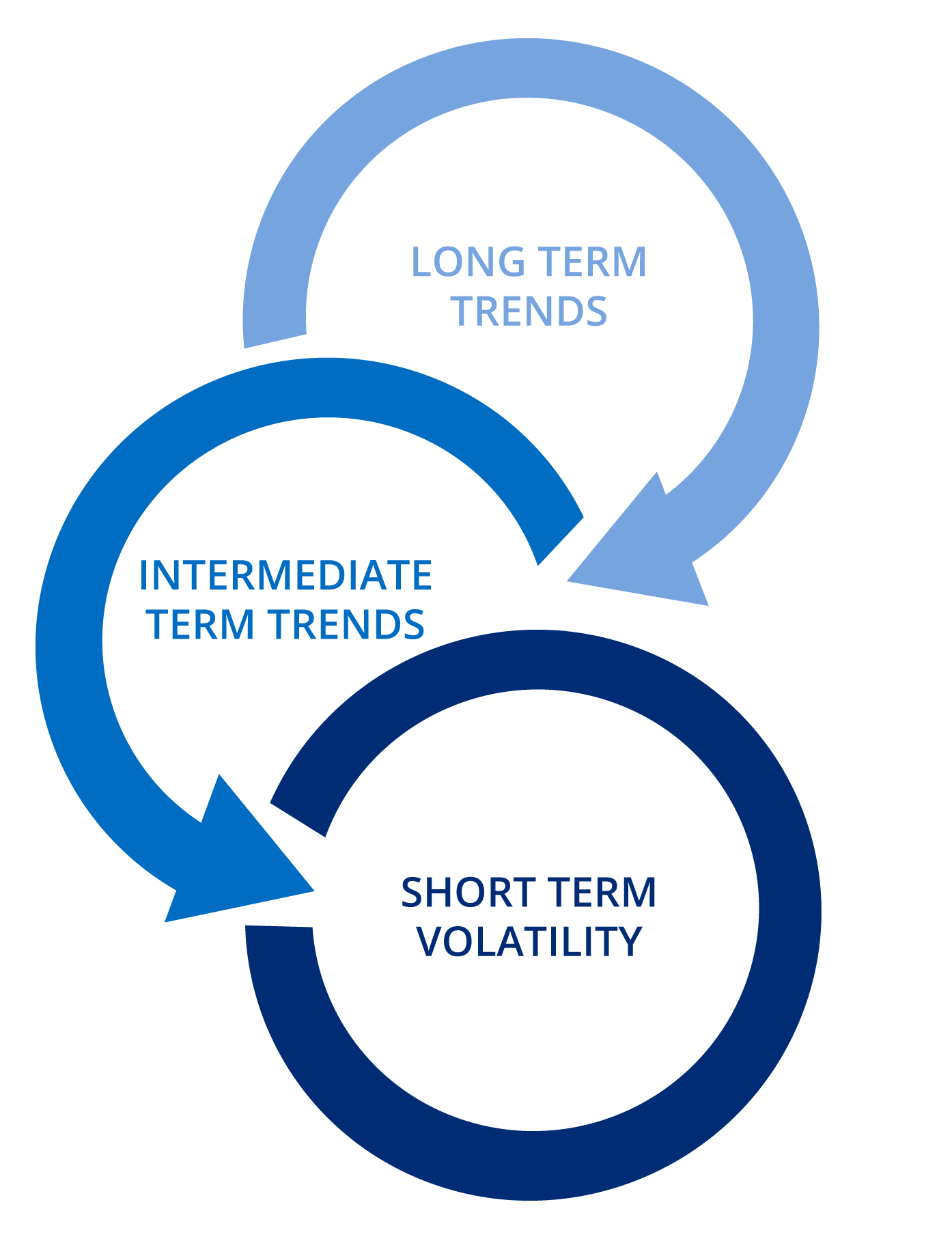

Diversified Risk Management

Risk and opportunity don’t always exist in the same time frame. Short-term volatility may represent a long-term opportunity and vice versa. That’s why our approach to risk management seeks to smooth portfolio returns by adjusting to market trends over long, intermediate and short-term time frames.The result is a proactive strategy of risk-management that seeks to benefit from a wider set of opportunities across time horizons.