April 10, 2024

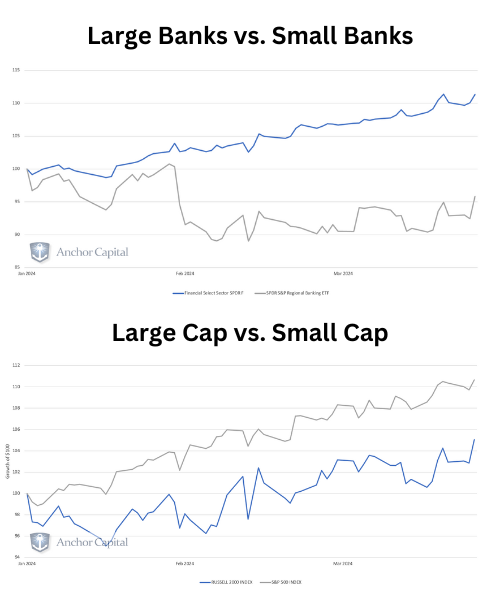

We’re watching the spread grow between large banks, small banks and regional banks. It’s happening because the larger banks appear to be doing better at the expense of their smaller competitors. So, you’re seeing situations where large banks go up while small banks go down. It’s a big spread, and it’s growing. What it’s really showing is that, as the […]