Equities, Fixed Income and the Power of a Strong Midfield

March 4, 2024

What Could Possibly Go Wrong?

March 14, 2024As goes housing, so goes the economy.

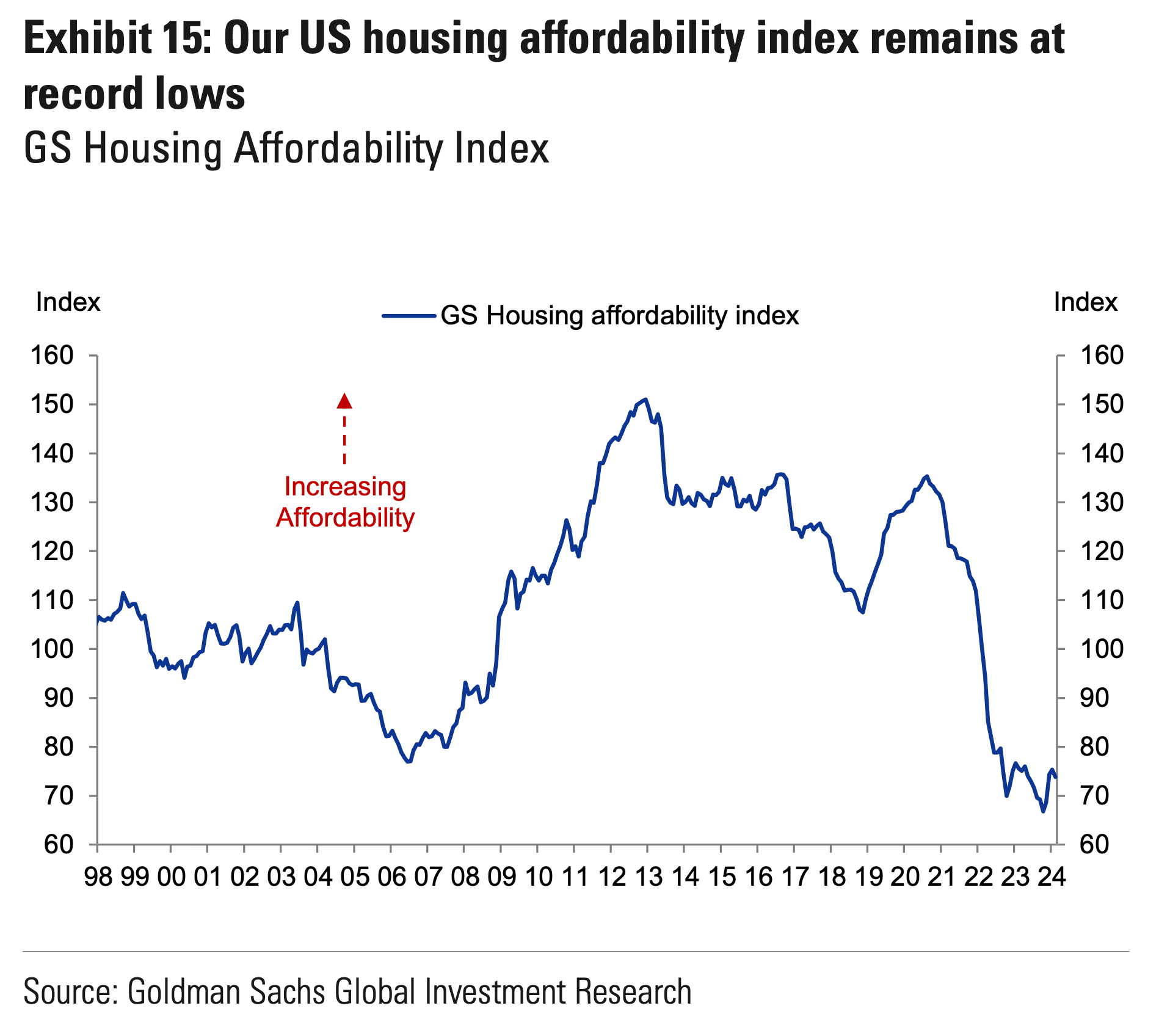

Mortgage rates just hit an all-time high, while at the same time housing affordability is at all-time lows.

One may not have caused the other, but the result is the same: No one can afford to buy a home right now. You can see it clearly in the chart above.

As of 2024, housing is less affordable for the average buyer than it has been for nearly 30 years, effectively the working lifetimes of millions of people. Unless home prices start dropping, or potentially interest rates ease up, no one’s going to be buying houses anytime soon. If these start to revert, it will add volatility to the market.

As risk managers, we’re always watching for risks like this. To learn more about why we think the way we do, give us a call.

Subscribe to Access Our Latest Thinking and Research