Feeling it at the Grocery Store, Feeling it at the Pump

April 22, 2024

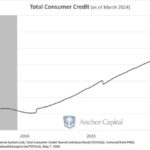

What Total Consumer Credit is Telling Us About Volatility

May 22, 2024The bond market has been going through an extended drawdown period, dating back more than three years.

And it’s getting worse.

Just this year alone, treasuries and aggregate bonds are down sharply, on the heels of double-digit drawdowns since 2021.

This is not just causing issues for bond investors, but for just about anyone who is relying on fixed income to mitigate the volatility in their portfolio.

That’s because the traditional 60/40 portfolio is anchored in 60% equites, and offset by 40% bonds. Those bonds are there to smooth the overall ride and ensure that the portfolio is not too volatile over the long term.

But, when bonds themselves are falling, they aren’t able to offset stock market volatility like investors expect.

At Anchor, we know that volatility management is a critical part of portfolio construction. But, when bonds aren’t doing it, it’s time for some more thoughtful solutions.

#EyeonVolatility