Bond Drawdowns are Changing Volatility Management

April 30, 2024

Borrowers Are Struggling to Pay Down Their Debt, and the Economy is Starting to Notice

May 31, 2024When everyday Americans struggle to pay their bills, they often turn to credit to make up the difference.

Groceries end up on the credit card. Maybe that line starts to carry a balance from month to month. Or, late fees start to pile up on the car loan.

It’s a common warning sign that all is not well in the day-to-day economy for actual consumers.

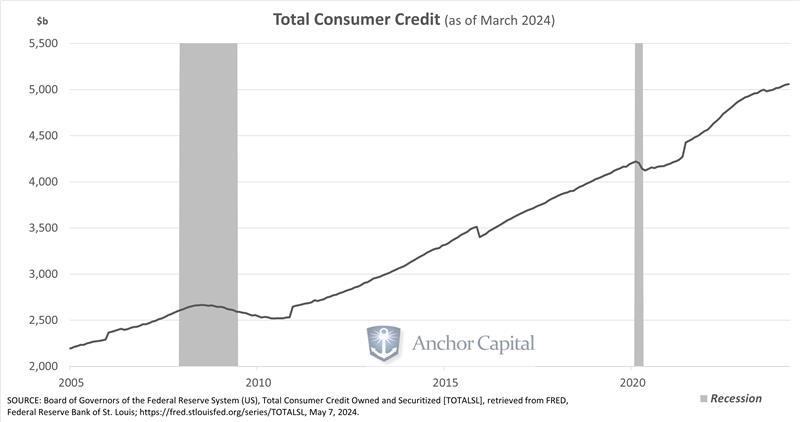

The Fed tracks this trend though what it calls Total Consumer Credit, which is a measure of all the consumer credit in the U.S. It includes everything from credit card debt, to auto loans, student loans, and more. Anything used by individuals or households to pay for personal expenses.

And, as you can see in the chart below, that figure has been rising fairly steadily for the last 20 years.

Growing total consumer credit is not always a bad thing; sometimes it reflects growing confidence in the economy and a willingness to take on debt to finance large purchases. Case in point: The measure tends to dip during recessions.

But too much credit can weigh down economic growth and put a damper on overall activity, as more and more people focus their attention on servicing their debt and less on consumption. Less consumption leads to less demand, which creates more volatility across the market as businesses suddenly find themselves with more supply than they need.

#EyeonVolatility