What Total Consumer Credit is Telling Us About Volatility

May 22, 2024

Banks are Looking at $500B+ in Unrealized Investment Losses. Should we be Concerned?

June 17, 2024A healthy economy relies both on banks being able to lend out money to support economic activity, and borrowers being able to pay back those loans so future lending can occur.

Lately, one side has not been holding up their end of the bargain.

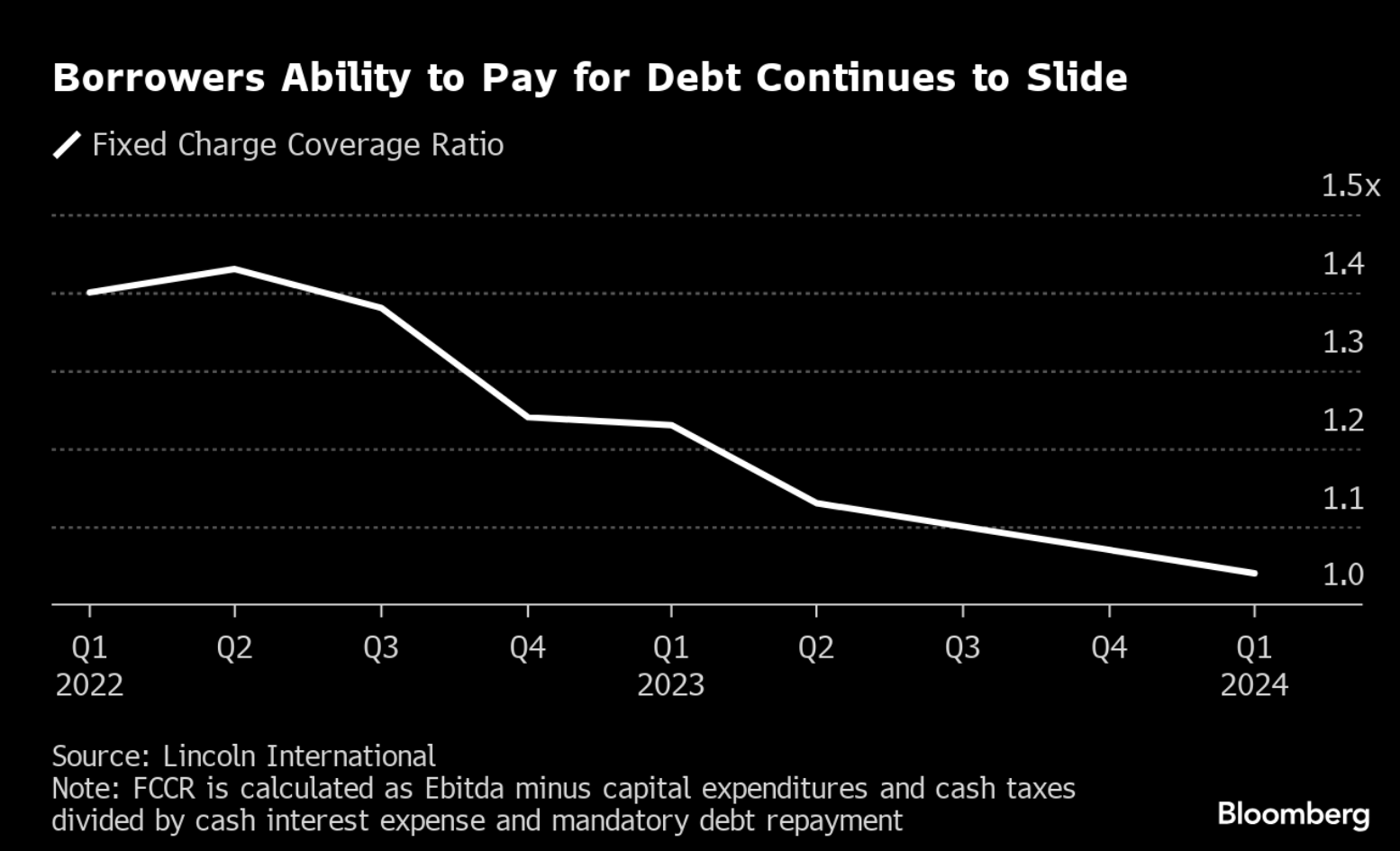

As shown in the chart below, borrowers’ ability to pay their debts has been on a downward slide since 2022, dropping by nearly half in just a couple of years. And there’s no end in sight.

Concerningly, this is playing out in the fixed-charge coverage ratio, which measures firms’ ability to cover their fixed expenses, including debt payments, interest expense, equipment leases, etc. These are businesses that are struggling to pay their debts, pointing to a potentially larger problem on the horizon when those businesses start to pull back on payroll, hiring, etc.

When we look for the root causes of market volatility, these are metrics that we look at due to the broad impact that these sorts of trends can have on the economy as a whole. And, based on this metric, we could be in for some extra volatility in the months and years ahead.

#EyeonVolatility