Warning Signs from High Yield Credit and International Markets

April 17, 2012

It was just 90 days ago that we were commenting on the record levels of volatility and little progress investors had been subjected to in the second half of 2011. In our “Oh Trend…Where For Art Thou” comments published in December we stated: “Long periods of sideways volatility creates pent up frustration for investors. Once a trend emerges, the inevitable “missing the boat” mentality […]

Oh Trend..Where For Art Thou?

December 12, 2011

A Flat 200 Day Average for U.S. Equities The lack of a discernible trend can be seen in the 200 day moving average. The 200 day average is widely accepted as a good indication of longer term market trends, and is illustrated in the chart of the S&P 500 below. Notice the clear rising and falling slope, regardless of Bull […]

NOT So Lazy Summer Days

July 31, 2011

Anchor Capital’s Absolute Return strategies have remained hedged and/or net short during this decline, with several strategies positive on the month in the face of record declines. More on those records later. Here is a brief overview of current markets, and where we see opportunity. On Friday, August 5th 2011 Standard & Poor’s downgraded U.S. treasuries from AAA to AA. The […]

One of These Things is Not Like the Other

June 3, 2011

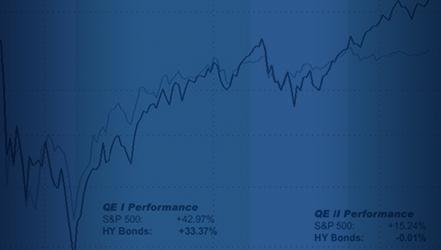

In short, while equities have benefited from the record amount of stimulus provided through the Fed’s Quantitative Easing program, corporate credit has not. As credit tends to be a better leading indicator of the economy then equities, this represents a significant warning sign. The chart below highlights the dramatic difference in how corporate credits responded to QE I compared to […]

Respect for Risk Almost Non-Existent

February 24, 2011

The Vix. Current VIX levels have corresponded with short and intermediate term market tops over the past several years. Margin Debt Near Dangerous Levels The January NYSE Margin Debt report is showing total portfolio borrowing hit a peak of $290 billion, and that available free credit has dropped to levels not seen since the credit bubble peak in July of […]

Doctor Doctor–Market Challenges for 2010

September 30, 2010

So far 2010 has been an exceptionally challenging year for most investors. In my experience, nothing drives investors more mad than headline-charged markets that make no progress. High volatility without a defined price trend has left both amateurs and professionals frustrated. The environment has been so challenging that even some of the world’s most successful hedge fund managers with stellar […]