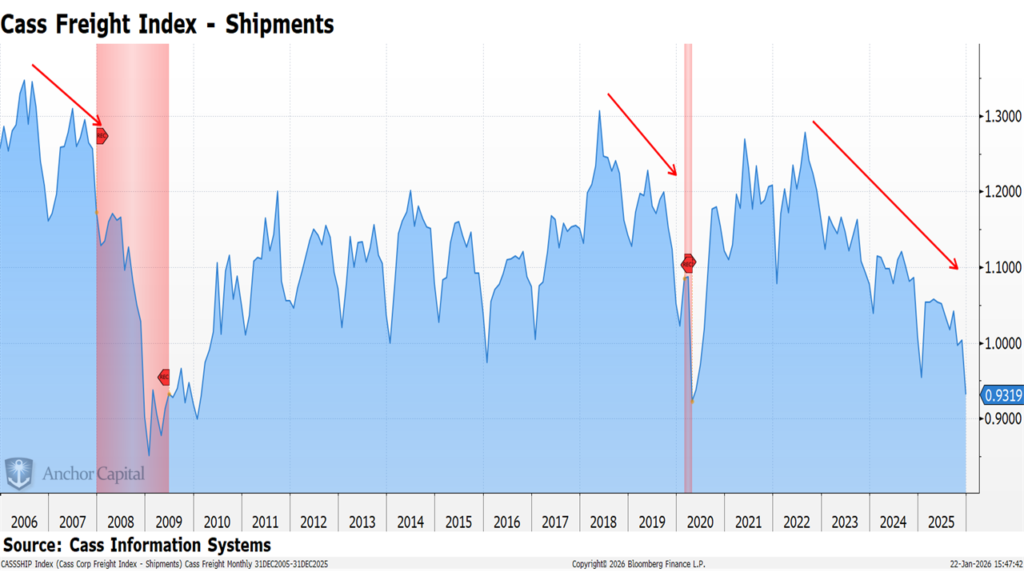

Freight doesn’t get a lot of hype or attention, but shipping metrics can tell us a lot about the state of the economy.

The Cass Freight Index tracks how much stuff is actually moving across the U.S. And historically, when freight volumes fall, a recession often isn’t far behind.

Why? Because companies cut shipments first: less production, leaner inventories, softer demand.

Look at the chart below and the pattern is hard to ignore. Every major drop in freight activity lines up closely with past recessions.

What makes this moment different is the duration. The current downtrend has stretched from 2022 through 2025, longer and deeper than most cycles, pushing shipment volumes back near levels last seen after the 2008 financial crisis and the 2020 COVID shutdown.

Freight tends to weaken before the headline economic data does. That makes this a signal worth watching. Not just for logistics, but for anyone thinking about corporate demand, industrial production, or where the economy is headed next.