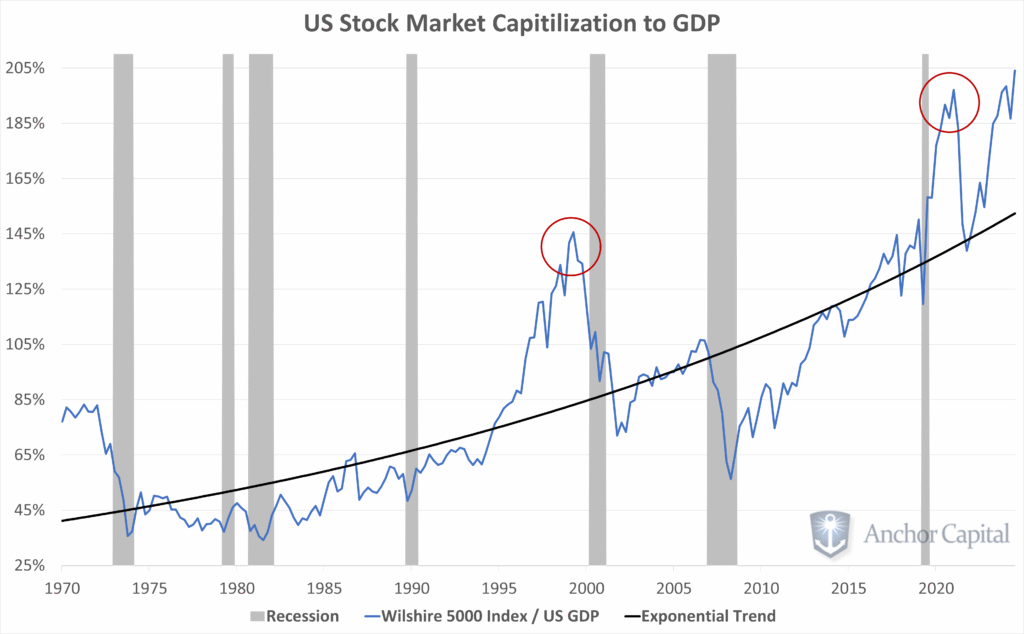

The “Buffett Indicator” just hit new highs.

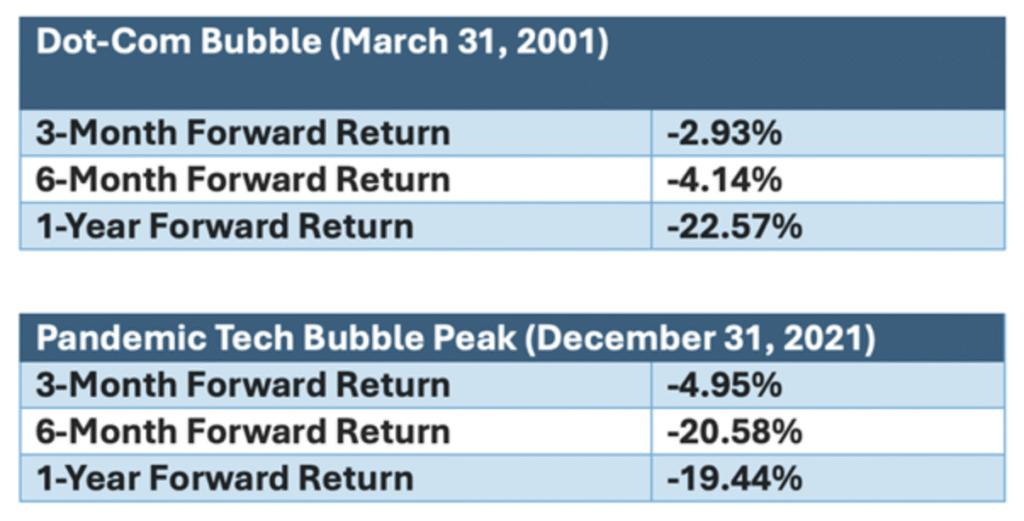

As of June 30, total U.S. stock market cap is 204% of GDP, higher than the dot-com bubble and the 2021 peak. That’s also 52% above its long-term trendline. Historically, forward returns from such elevated levels have been notably poor.

Translation: markets are running hot, while the economy still faces slowing growth, sticky inflation, and global uncertainty.

When valuations stretch this far, the playbook shifts. It’s less about chasing upside, more about managing risk.

#EyeOnRisk #EyeOnVolatility