The cost of carrying margin debt in the US is now sitting near — or even above — levels typically seen before major market downturns.

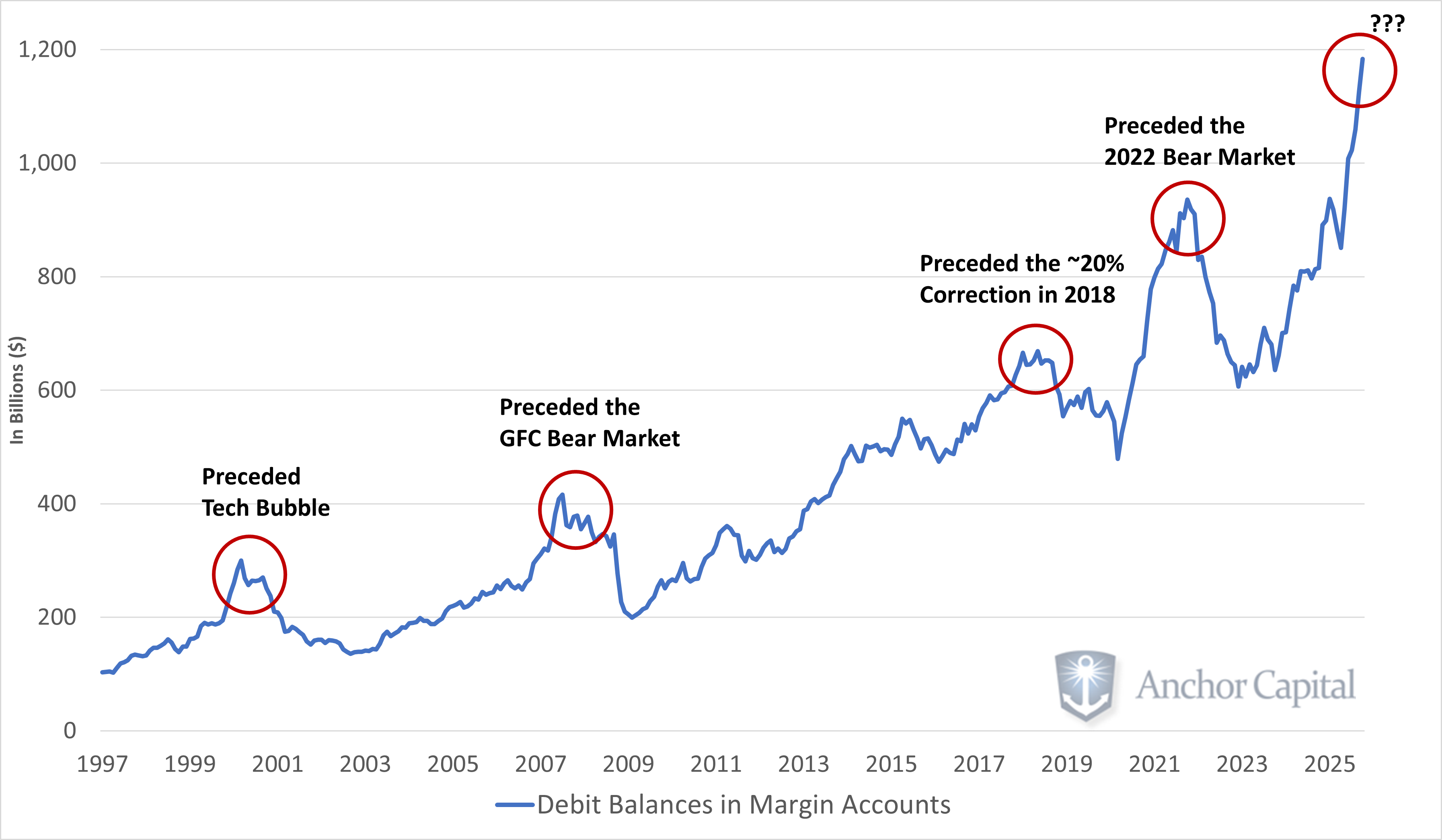

Several indicators suggest that, historically, US stocks may be approaching the end of their bull run. History doesn’t always repeat itself, but we are observing high margin levels that are prompting us to pay very close attention. Margin debt is the amount owed to brokers, allowing investors to buy securities with leverage or borrowed funds by using their portfolio as collateral.

When you look at net margin debt funded at prime + 2% as a share of GDP, today’s levels are approaching historical peaks. And those spikes have a pattern: they’ve preceded some of the market’s biggest pullbacks, including the tech bust (2000), the Global Financial Crisis (2008), the ~20% correction in 2018, and the 2022 bear market.