AI isn’t just changing technology, it’s reshaping how inflation impacts the economy. We’re shifting from static computing to AI-driven systems that can generate exponentially more output.

That shift is bringing with it a massive new appetite for computing power and energy.

Hyper-scalers are racing to keep up, pouring billions into new data centers and infrastructure. However, a new kind of inflationary pressure is starting to show up in unexpected places.

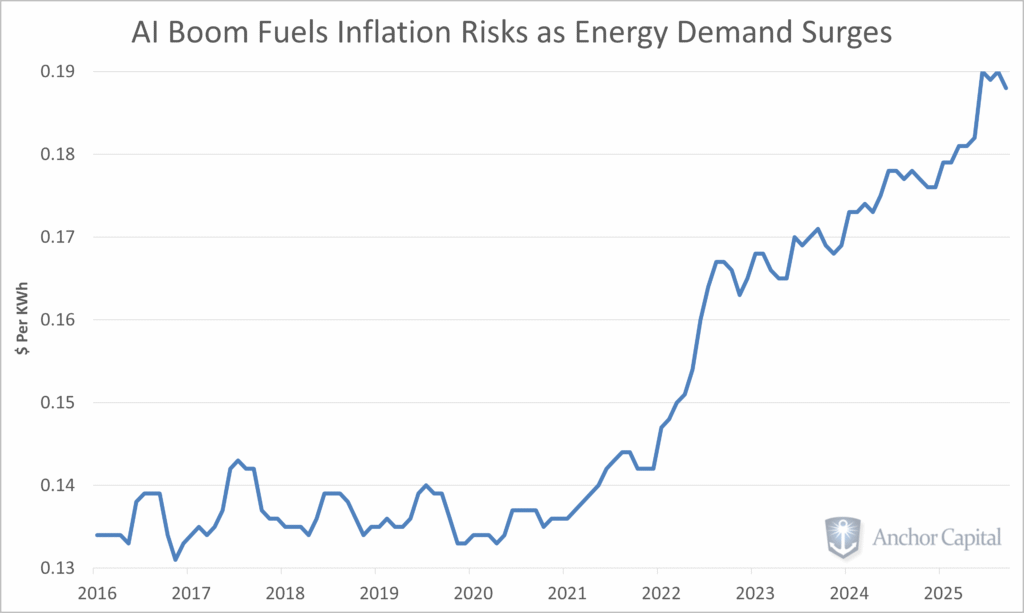

Electricity prices in the U.S. are rising. Freight and food costs are climbing, too.

As a result, inflation appears to be more broad-based and persistent than the Fed would like to admit. While the Federal Reserve may be slow to adjust, Treasury markets could move first, pricing in the next phase of this AI-fueled inflation cycle.

AI may be the spark of a longer structural inflation trend, one that could reshape monetary policy, market expectations, and how we think about “growth vs. inflation” for years to come.