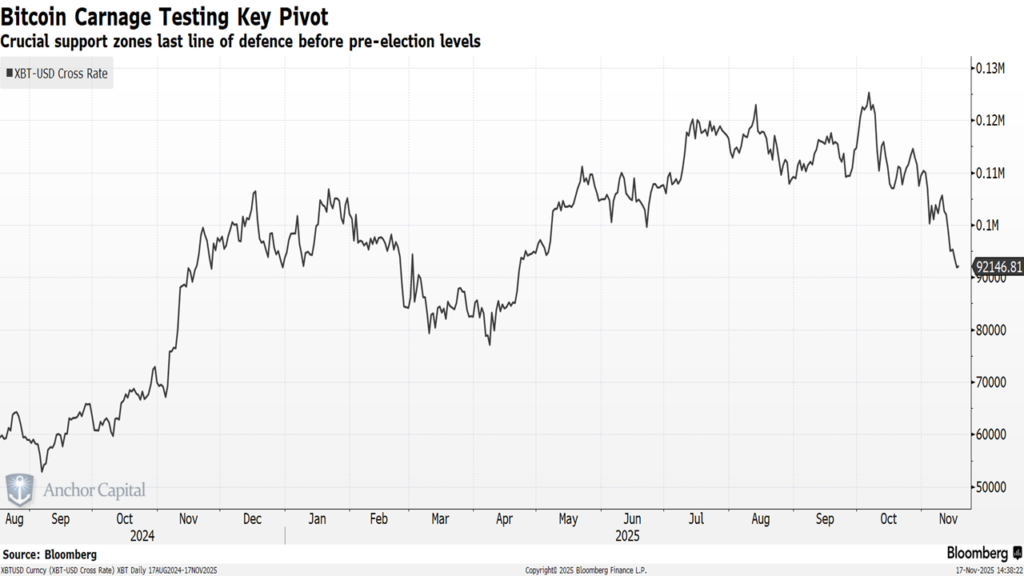

Bitcoin has officially erased its year-to-date gains, down 17% in November and now -9% for 2025 (as of 12/1). That’s a sharp reversal for what had been the best-performing major asset class of the year.

What’s happening? The pullback is exposing just how fragile risk appetite really is. Instead of behaving like a portfolio diversifier, crypto is once again acting as a high-beta proxy for broader market sentiment.

Earlier in 2025, institutional flows through ETFs and corporate balance sheets helped power Bitcoin higher. But that demand has cooled.

Since Bitcoin peaked at $126K in early October, roughly $600B in market value has evaporated. The shift in conviction has been fast and unforgiving.

When liquidity dries up and volatility spikes, crypto is one of the first places investors tend to de-risk.