The easy income era is ending.

For the last couple of years, parking cash in short-term U.S. Treasuries paid yields above 5%. That trade is fading fast as the Fed continues cutting rates.

Now the math is getting harder.

Safe yields are shrinking, forcing income investors into uncomfortable choices like extending their duration, giving up liquidity, or taking on more risk.

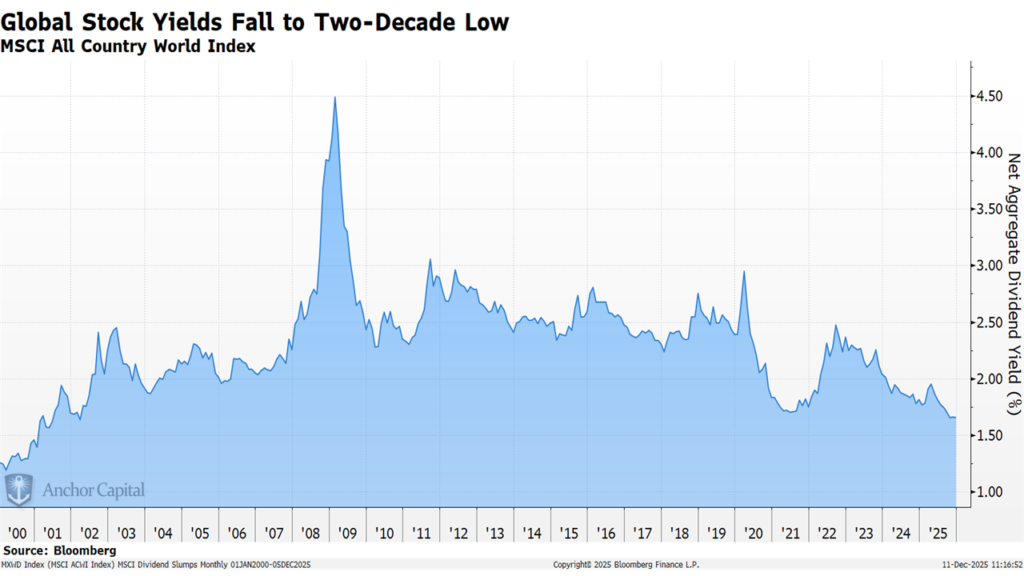

Additionally, outside of fixed income, global equity dividend yields are hovering just above multi-decade lows. Equities provide less income as companies opt for stock buybacks over dividends. This is making it incredibly difficult for income investors to find an attractive yield in this market environment.

Income investors will be challenged to find similar yields to those of past years without substantially increasing their risk. Risk-managed income strategies may be the solution for the years ahead.